Our secret to predict customer churn

The importance of customer churn

Some research shows that it costs five times as much to acquire a new customer than to keep an existing one. What’s more, when nurtured correctly, existing customers are more likely to keep purchasing and become brand loyalists. Brand-loyal customers tell their friends about your company, are more likely to try new products, and are less likely to be chased away by a price increase.

Customer churn can manifest in different ways for different businesses, but it can be generally defined as what happens when a customer unsubscribes from your service, ceases to purchase from you, or simply stops engaging with your brand. Customers leave for a variety of reasons, and it’s an inevitable part of doing business.

Still, too many companies fail to properly address customer churn. While usually no expense is spared to find and attract new customers, the same seldom applies to identifying customers which are ready to join your competitor. But how exactly can you focus your efforts on the right customer?

The impossibility of generalizing churn

One of the major questions is how to define customer churn in the first place as it differs across businesses and situations.

Think about it as a relationship, every relationship has its interaction frequency. Personal relationships can be intense where people meet daily. Other relationships can have a much lower interaction frequency, where people who meet every few months or even once a year have very significant relationships with each other.

Relationships with different interaction frequencies will also end in different ways. In intensive relationships, a break of a few weeks or months will be regarded as remarkable and might signal that something in the relationship has derailed. In the context of other relationships, a silence of a few months or even a year will not be so uncommon.

The same story goes for relationships between companies and their customers. Customers communicate in different ways and with different frequencies, making it difficult to determine when a customer is about to say goodbye to you.

For example, subscription businesses that don’t allow pausing service is easy to define, it’s when customers unsubscribe. But for other e-commerce businesses, churn has a more vague definition of someone who stops purchasing, and so must be identified through other means.

It may involve defining churners statically based on their previous transactional history: someone who has a pattern of buying a few times every two months might be considered churned after 6 months of no activity.

Simply put, calculating an accurate churn rate is difficult: it involves a lot of different formulas, effort, interpretation and to be honest, it’s quite a mess to do it the classical spreadsheet or business intelligence way. There is a more precise, accurate way to produce this information, however. The answer, as you may have guessed, lies in data science and machine learning.

Making customer churn prevention a priority

Most companies know it’s important to keep an eye on customer churn, but not all realize that keeping customers from churning is directly linked to their profitability. Brands, especially those in a mature market, need to be acutely aware of when their customers are about to churn and try to win them back before they do. Customers now have lots of options; unless you’re first to the market, there’s a chance they’ll never come back.

From our experience, we see that most companies here are very aware of this but lack the technology and know-how to accurately mitigate this risk. For example, a basic but commonly implemented approach is to use a basic, time-controlled metric. An example of this would be to consider a customer as churned after, say, three months. This one-size-fits-all approach ignores the interaction frequency of individual customers, the needs of the customer and usually leads to poorly timed and ineffective marketing strategies. Besides, it completely breaks down if a customer only partially churns, in other words, only stops buying some services or products.

When you automatically label customers as churned after a fixed time window, the behavior of each customer in the context is not taken into account. Presume to apply this approach to personal relationships. Calling your partner after three weeks of silence will give you a firm scolding. On the other hand, texting your colleague every two days during his summer holidays makes no sense at all.

Machine Learning is the key to making personalized solutions that do the heavy lifting

For the data-driven marketeer, it’s now even easier to understand customer churn in ways that were simply not possible before. The same impact customer data has on figuring out what kind of email marketing messages will resonate with clients can be used to understand exactly how and why, and now, when customers churn. It’s no longer contested that machines are better at crunching numbers and probabilities than we are. Even more significant is that now machine learning algorithms and modelling translate into computer programs that can adapt to the information being processed. By using models that take into consideration recency, frequency, and monetary values of customers who have purchased before, not only can these models calculate customer churn, they can take it a step further and predict.

Machine Learning helps pick up patterns of purchasing behavior by sifting through enormous amounts of data and identifying common attributes of customer behavior. This translates into being able to identify what kinds of customer action most often leads to churn, even if that action is something small or not easily measurable. The significance of predicting customer churn is not just the data provided, though that in itself is pretty remarkable. The true importance lies in what marketeers and salespeople can then do with that information, which is to use it to better understand your customers, and reach out to them according to where they are in the customer lifecycle. It turns something that is informational or analytical and takes it a step further to make it actionable. Identifying which customers are at risk of churning helps you know when you need to send them an offer to win them back. Predicting when they are most likely to churn gets you the information you need.

ML2Grow’s personalized approach to predict customer churn

Advertisements and offers are important to inform your customers better about your product range. Through printed matter, online advertisements and newsletters, this information finds its way to the customer, only what are the articles that you recommend? The best possible selection of items maximizes the number of sales, but each customer is unique and so a personalized selection is also necessary. The success of global players such as Netflix, Amazon or Facebook demonstrates the enormous power of this personal approach. We covered this in our previous blogpost how to boost your sales with recommender systems.

If you combine this with our recommender system to get the timing of your offers just right, it amounts to some serious next-level customer interaction.

Have a look at our use case with HLS in how we made a custom analysis, development and visualization platform for customer churn and how we integrated it with their sales team.

Predicting how likely a customer is to churn and when they will churn allows marketeers to preemptively engage with relevant offers, bringing lost customers back into the purchasing cycle is the end-game here. However, people stop being customers for any number of reasons, which makes predicting this value extremely difficult.

More than ever we see that general churn prediction algorithms offered out-of-the-box in data platforms do more harm than good, as they were designed to work in a general way, and fail to understand the specifics of your unique company-client relationship.

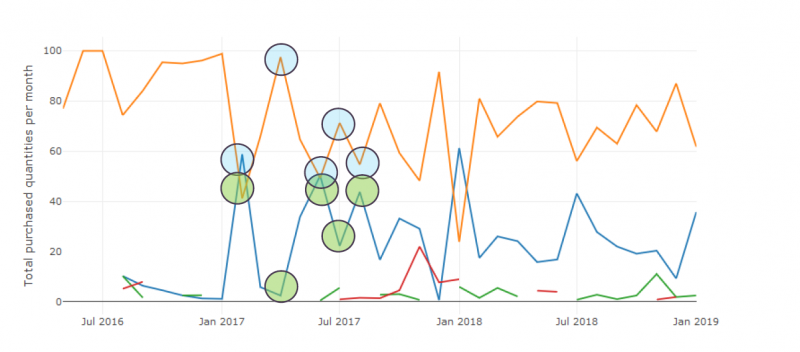

Take for example the following figure taken from a real use-case where classical and general AI models fail to be truly intelligent systems.

The graph represents the quantities of different items a specific customer bought over time and the different lines represent different products. Do you notice something special? Indeed, whenever the customer purchased the orange product more, he ordered less of the blue product and vice-versa. In this setting, a classical out-of-the-box system would constantly predict individual product churn on one of the two items. In reality, however, the customer had been a loyal customer for years and simply required more of the orange product when it was warm and more of the blue product while it was cold outside.

This is where our custom made machine learning models come in to help make predictions. A precise churn risk is calculated individually per customer based on the knowledge and insights extracted from all your customer interactions.

This approach gives companies a deeper and more accurate understanding of each customer’s behavior. Also, it gives you a much better chance to promote enduring customer relationships. Covered with this knowledge, companies can use personalized campaigns for customers at the right time to encourage loyalty and customer engagement.

ML2Grow has developed a method to accurately predict customer churn in which our unique approach for individual churn cut-off calculation is fundamental. This method has been tested and validated as an accurate and effective method.

Unburden yourself with our advanced churn prediction technology

We offer a cloud-based churn prediction platform to start from which can also be combined with our recommendation engine: a risk assessment is made for each customer based on the periodic data of items sold. We demonstrate how to detect changing customer behavior and how to identify customers who are about to cancel their subscription or purchases. We show how this can be avoided with a personalized adaptation.

Thanks to customer churn prediction you maintain focus and avoid expensive efforts in customer acquisition getting lost. More specifically in retail and wholesale, ML2Grow has extensive experience with recommender systems (which provide customer-specific product recommendations, or the distributor specifically recommend customers who are open to a particular product) and churn prediction, which automatically identifies the customers who are at increased risk. show on course. These techniques can also be used in reverse: identifying the worst recommendations as well as the customers with the lowest risk of churn or therefore the highest acceptance rate.

Without revealing too much about the secret recipe of ML2Grow’s customer churn prediction technology, the approach relies on a specific individual churn cut-off calculation and a unique adaption of the problem to a more traditional classification problem. By using more advanced models allows us to capture extra information in the system, such as details about the client, the orders and the products or services that are being sold.

Contact us today to learn more about how we can help you with ML2Grow’s Customer Churn Prediction technology. Allow us to easily optimize your marketing campaigns to increase existing customer spending and reduce customer churn.